Student grants for undergraduates

The Student Grant Scheme is the main source of financial assistance for full time students on undergraduate or PLC courses. It is available to eligible students in most colleges in Ireland as well as to eligible Irish students in many colleges in the UK (including Northern Ireland) and other EU member states.

Approved higher education colleges and PLC centres in Ireland are listed in the Student Support Regulations, see susi.ie for details. For a college in another EU state (including the UK) to be approved for the purposes of the Student Grant Scheme, it must provide higher education and training and must be publicly funded. Students on part time or short courses are not eligible for a student grant.

The eligibility conditions for the student grant include a detailed means test (see page 4). The level of means determines whether a student qualifies for a full rate of grant, a partial rate, or the special rate for disadvantaged students.

Since 1 September 2015, school leavers who have been in the asylum protection system for more than five years and who meet certain criteria can apply for student supports under the Pilot Support Scheme.

Components of the student grant

The student grant for undergraduates is made up of a maintenance grant and a fee grant.

A maintenance grant is a contribution towards a students living costs. Maintenance grants are available for approved courses at undergraduate level in approved institutions in Ireland and other EU states.

A fee grant can cover any or all of the following elements:

- All or part of the Student Contribution

- Costs of essential field trips

- All or part of a students tuition fees

In general, if you qualify for a maintenance grant you will qualify for all relevant elements of the fee grant. However, you will not get the tuition element of a fee grant if your fees are paid under the Free Fees Initiative. (In practice, most undergraduate students in Ireland qualify for free fees.)

Students doing PLC courses do not get fee grants, but if you qualify for a maintenance grant you will be exempt from the PLC participant contribution.

Fee grants are available for approved courses at undergraduate level in Ireland but not for courses elsewhere in the EU.

Qualifying for a student grant

To qualify for a student grant, you must pass the means test and meet the other conditions of the scheme, including those relating to residence, nationality and immigration status. You must also be attending an approved course. There are detailed conditions about the level of the course you are attending about whether you have attended a course at the same level already and about whether the course represents progression from your previous studies.

In general, you will not get a grant for repeating a year or attending a course at a level that does not represent progression from courses you have completed before.

However, second chance students may be eligible for a grant. A second chance student is someone who is aged over 23, did not successfully complete an earlier course and is returning to pursue an approved course after a break in studies for at least five years. You may qualify for a fee grant, but not a maintenance grant, if you are what is called a tuition student under the Student Grant Scheme. A tuition student is someone who meets all the conditions for a student grant except for residence in the State, but who has been resident in the EEA or Switzerland for three of the last five years.

Nationality and immigration status

In general, you must meet one of the following main conditions in order to get a student grant:

- Be a national of an EEA member state or Switzerland

- Be a family member of one of the above, with permission to remain in the State as a family member of such person under the provisions of the European Communities (FreeMovement of Persons) Regulations 2006 and 2008

- Have refugee status

- Have permission to remain in the State by virtue of marriage to, or civil partnership with, an Irish national living here or be the dependent child of a person with such permission

In addition, certain non EEA nationals may apply for a student grant if they have a particular type of leave or permission to live in the State. See the website susi.ie for details.

Residence

You must have been legally resident in the State for three of the previous five years to qualify for a maintenance grant. However, if you are studying elsewhere in the EU for a recognised qualification, and you were resident in the State for three of the five years before starting that course, you satisfy this requirement.

If you meet all the criteria for a maintenance grant except for the residence condition, you may still qualify for a fee grant as a tuition student.

Means test

The means test for a student grant is generally based on your familys income for the previous full tax year. For the academic year 2015/2016, the previous full tax year was 2014. However, if you or your family have had a change of circumstances in the current tax year, your changed circumstances may be taken into account.

Some social welfare payments are excluded from reckonable income for the purposes of student grants. Examples are Child Benefit and Family Income Supplement other payments that are exempt are listed on susi.ie.

Most students will be regarded as dependent for the purposes of the means test. However, if you are aged over 23, you will be regarded as an independent student, unless you were ordinarily resident with your parents or guardians from 1 October of the year preceding the year of entry to the course. (For simplicity, we refer to parents rather than parents or guardians from here on.)

The income (if any) of a dependent student is assessed together with the income of their parents. An allowance is made for your earnings outside of term time up to 3,809 currently.

If you are an independent student, you are assessed on your own income (and that of your spouse, civil partner or cohabitant, if applicable). You can reclassify from a dependent student to an independent student if:

- You progress from further education to higher education or

- You have a three year break in your studies or

- You are returning as a second chance student after a five year break in your studies

Income limits for maintenance grant and full fee grant

The amount of the grant to be paid will depend on the level of family income and the number of dependent children.

The family income limits for eligibility for a maintenance grant in 2015/2016 are set out below. These income limits are applied after your means are assessed. The income limits also apply to the fee grant (that is, if you do not qualify for the Free Fees Initiative and are eligible for a fee grant).

Income limits for partial fee grant

If you do not qualify for a maintenance grant, but your family’s reckonable income is below certain limits, you may qualify for a partial fee grant. Depending on your familys income and the number of children in the family, you can either be exempt from 50% of the Student Contribution, or exempt from 50% of any tuition fees and all of the Student Contribution.

The family income limits for a partial fee grant in 2015/2016 are set out below. The 50% tuition fee grant is not payable if your fees are covered under the Free Fees Initiative.

Family income limits for partial fee grant

Other family members in college

If other members of your family are doing a full time course of at least one years duration, the reckonable income limits may be increased.

Special rates of grant for disadvantaged students

Disadvantaged students who meet certain conditions can qualify for a special rate of maintenance grant.

Applicants must have qualified for the standard maintenance grant. In addition, total reckonable income in the last full tax year must be below a certain limit.

If you are assessed on your parents income, on 31 December of the previous tax year, one of your parents must have been claiming a long term social welfare payment or Family Income Supplement, or else participating in a designated programme, such as a Community Employment Scheme. For students who are assessed on their own income, on 31 December of the previous tax year you must have been getting one of these social welfare payments or participating in a designated programme.

How to apply for a student grant

Student Universal Support Ireland (SUSI) is the single awarding authority for all new student grant applications. Before SUSI was established, grant applications were handled by local authorities and Vocational Education Committees, which have now been replaced by Education and Training Boards (ETBs). Renewals of existing grants are generally handled by the body that initially issued them.

Student grants are reviewed each year. If you had a grant in one academic year and are continuing your studies on the course in the following year, the body that awarded the grant will be in contact with you in order to renew or reassess your student grant for the following year.

All new grant applications are made online on the SUSI website, susi.ie. You do not need to know which exact course you will be attending in order to apply for a grant.

Appealing a decision

If you think that you have been incorrectly refused a grant, you may appeal by writing to the body to which you applied. You must appeal within 30 days of getting your decision. If your appeal is turned down, and you feel that the conditions have not been interpreted correctly, you can make a further appeal to the Student Grants Appeals Board.

Financial assistance for postgraduates

The Student Grant Scheme provides for some financial assistance with the cost of tuition fees for approved postgraduate courses in Ireland and Northern Ireland. There is no assistance under the Scheme for postgraduate courses elsewhere in the EU. Postgraduate courses are not covered by the Free Fees Initiative. However, you may be able to claim tax relief on postgraduate fees paid.

There are two types of assistance for postgraduates under the Student Grant Scheme. You may either:

- Get a flat rate fee contribution of 2,000, if you pass the means test (see page 4), or

- Get all tuition fees paid (up to 6,270) including essential field trips, if you meet the qualifying conditions for the special rate of grant for disadvantaged students

To qualify for assistance under the Student Grant Scheme you must also meet its criteria for nationality and immigration status and for residence.

Fee contribution means test and income limits

The rules for this means test are the same as for student grants at undergraduate level. However, the family income limits are different.

Back to Education Allowance

- Undergraduate students

If you are unemployed, parenting alone or have a disability and you are getting certain payments from the Department of Social Protection, you may attend a third level (or second level) education course and get the Back to Education Allowance (BTEA). You can start part time work during the academic year without affecting your BTEA payment provided the work does not affect your studies and college attendance. If you qualified for BTEA from Jobseekers Benefit since 1 January 2015 part time work does affect the rate paid.

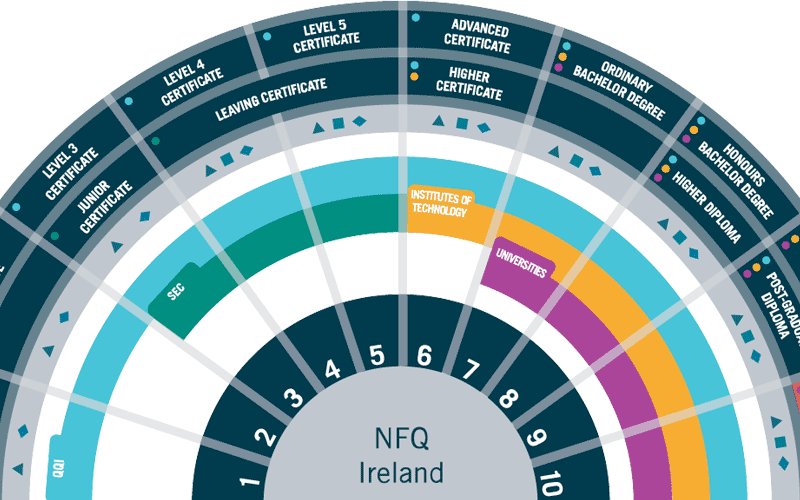

BTEA covers full time second level courses and third level courses to higher diploma level (level 8 in the National Framework of Qualifications) as well as the Professional Masters in Education. You can attend an undergraduate full time day course that is approved for the Student Grant Scheme in another EEA state and get BTEA. Postgraduate courses must be in Ireland to be eligible. - You cannot get a BTEA and a student maintenance grant together (see page 7). Although you are not entitled to the maintenance component of the student grant, you must still submit a student grant application form to be assessed for a fee grant to pay your Student Contribution, field trip costs and tuition fees (if payable).

Since June 2014, all new BTEA claims from jobseekers must be recommended by a Department of Social Protection (DSP) case officer.

People coming from jobseekers payments or Farm Assist are paid BTEA for the academic year only and not for the summer months between academic years. If you are getting BTEA and cannot find work over the summer you may be able to claim a jobseekers payment if you meet the usual qualifying conditions. It is paid over the summer to people coming from all other qualifying payments (including Jobseekers Transitional payment) provided they are progressing to the following academic year of their course of study or to another approved course of study under BTEA after the summer. - Qualifying for Back to Education Allowance

In general, to qualify for BTEA you must be aged over 21 (with some exceptions) and have been getting a qualifying social welfare payment immediately before you start the course. For third level courses you must have been getting a qualifying payment for nine months before the start of the course.

You can attend any third level course of education that is approved for the Student Grant Scheme. The course must be a full time day course. In general you must be starting your course in first year. There are some exceptions to this rule.

If you have to repeat a year of your course because you have failed the year or because of exceptional circumstances (for example, pregnancy or illness) you can be paid BTEA for the repeat year. However you must be registered and attending as a full time student for the repeat year. You can only repeat one academic year and continue to be paid BTEA. In most cases, you must also pay tuition fees yourself during that year.

Since 1 January 2015, you no longer qualify for BTEA when your Jobseekers Benefit ends after six or nine months. You must qualify for another payment to continue to get BTEA. Citizens Information Board Relate – January 2016 page 7

People who qualified for BTEA from Jobseekers Benefit before 1 January 2015 can continue to get BTEA until the end of their course and if they are progressing to a new approved course. For new BTEA applicants in 2015/2016, if you were getting a jobseekers payment, Farm Assist, a One Parent Family Payment or a Jobseekers Transitional payment, you must re establish your entitlement to a primary payment to continue to be entitled to BTEA for the second or subsequent years of study.

Unemployment or illness credits

If you are signing on for unemployment credits or submitting medical certificates for illness credits for the required period of time, you may participate in the BTEA scheme on a non payment basis. This means that you continue to be awarded the relevant credited contributions while you are taking part in the BTEA scheme but you do not get a weekly BTEA payment.

If you are participating in the BTEA scheme on a non payment basis, you can apply for a student grant to be assessed for both the fee and maintenance components of the grant.

Secondary benefits

If you qualify for BTEA, you can keep your entitlement to any secondary benefits you already get, such as Fuel Allowance or Rent Supplement. However, any increase in income may affect your entitlement to Rent Supplement or the amount of supplement you get.

Postgraduate students

BTEA is not paid for most postgraduate courses. However, you can get BTEA for a postgraduate course of study in Ireland that leads to a Higher Diploma qualification in any discipline or a Professional Masters in Education.

In general, other types of postgraduate qualifications are not recognised for BTEA. The only exception to this is where a college has admitted a person without a diploma or primary degree to a Masters course on the basis of relevant life experience.

To qualify for BTEA as a postgraduate you must be over 24 years of age and have been getting a qualifying social welfare payment. You must also have been accepted onto a qualifying course. You will not get BTEA if you already have a postgraduate qualification. For Higher Diploma courses you must have been getting a qualifying payment for nine months before you start of the course. For the Professional Masters in Education, you must have been getting a qualifying social welfare payment for 12 months.

You can apply under the Student Grant Scheme for assistance with the cost of tuition fees for approved postgraduate courses in Ireland and Northern Ireland (see page 5).

Back to Education Allowance and the student grant

If you are getting BTEA you do not qualify for the maintenance component of the student grant but you can apply for a fee grant to cover the Student Contribution and any course tuition fees not already covered by the Free Fees Initiative. Essential field trip costs may also be covered under a fee grant. You must meet the conditions of the Student Grant Scheme to qualify for a fee grant.

If you are getting Jobseekers Benefit or Jobseekers Allowance, you must transfer to BTEA if you wish to keep your social welfare payment when you go back to education.

If you are getting a One Parent Family Payment (or Jobseekers Allowance Transitional payment) or a disability payment (Disability Allowance, Invalidity Pension or Illness Benefit), you can choose to stay on your current social welfare payment (if you continue to meet the rules of the scheme) and apply for a maintenance grant or you can choose to transfer to the BTEA, depending on which option benefits you most. Rent Supplement is not paid to people in full time education unless they are getting BTEA.